When you are fundraising, you need to get these meetings right.

Of course, you know your business inside out. The real question is: are you certain you can give a compelling and engaging story about it?

WHY RAISE MONEY?

• to purchase equipment, rent of ces, and

hire staff

• most importantly to GROW FAST

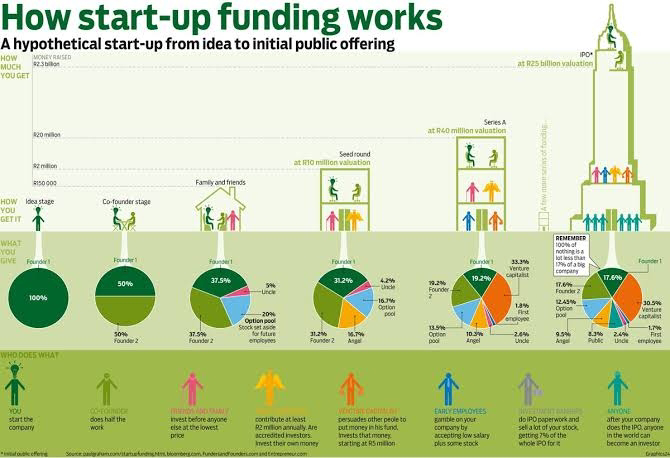

Sources of Funds:

1. F.F.F. — Family, friends, & fools

2. Private Investors — Angels & Venture

Capitalists (VC)

3. Public Investors (thru IPO) — Stock Markets

WHAT INVESTORS INVEST ON?

1. Traction — customer adoption

2. Big Market Size — market

opportunity & product-market t

3. The TEAM — founder’s story and

reputation

INVESTOR PITCHING

1. Elevator Pitch — a one minute pitch you tell to

an investor what your product is within a one

minute elevator ride.

2. Short Form Pitch — a 3-10 minutes long pitch.

3. Long Form Pitch — a formal pitch that tells

investors everything they need to know about

your company (20 minutes long).

Fundraising Guide: Ten tips for better fundraising

1. Pitch success starts with how you prepare

2. Refine your investment story

3.Use a clear presentation structure

4. Have a 2-way conversation

5. Look like an A-Team

6. Remember the non-verbal

7. Embrace questions

8. Manage your energy

9. Practise, practise, practise

10. Check everything

Fundraising Presentations Tip #1. Pitch success starts with how you prepare

Too many good fundraising opportunities get lost in boring, run-of-the-mill presentations.

A great investor PowerPoint is not enough: you and your team are the presentation.

So, don’t start planning your pitch with PowerPoint – instead start with a lot of thinking and a blank sheet of paper. Ask yourself:

• Who exactly is my potential investor – and what do they want?

• What do I want to achieve – how am I going to sell our investment opportunity?

• How can I hook people – by grabbing their attention early on?

• What is my takeaway message – the one that I want to be remembered for afterwards?

“It’s not supposed to be easy. If it was, then everyone would do it.”

Fundraising Guide Tip #2. Define and refine your investment story

The way you frame your investment story influences how an investor sees you.

Investors need to understand why your opportunity is special, and what makes it stand out from other opportunities.

• What does your team do differently?

• What is your edge’?

• How will you consistently drive better results?

Successful fundraisers craft a compelling story – around their strategy, and they tell it with passion.

So, what makes a compelling investment story? According to Forbes, the perfect selling story involves:

• Being relatable – connect with investors by highlighting a scenario relevant to them

• Detailing a conflict – introduce a challenge you’ve overcome to encourage empathy

• Presenting the resolution – to demonstrate your expertise

• Demonstrating results – the human impacts, qualitative results and quantitative outcomes.

Fundraising Presentations Tip #3. Use a clear presentation structure

Investors tell us that the best fundraising presentations are the ones where they are taken on a journey.

You can achieve this by reviewing your narrative towards the start of your pitch – this should sound like an executive summary, not an agenda.

A simple structure – with a clear beginning, middle and end – demonstrates your command of your own story.

It also helps investors quickly grasp what you do and why it works.

Successful fundraisers also limit their narrative to a maximum of three key messages.

Highlight the big themes that are going to have the greatest impact so that you get everyone on the same page.

Fundraising Presentations Tip #4. Have a two-way conversation

“The less people know, the more they yell,” says marketing guru Seth Godin.

Investors find it frustrating when a fundraising pitch is a one-way broadcast and you don’t give them the opportunity to ask questions.

It’s much more effective to have a conversation. Two-way communication allows for instant feedback, clarification and interaction.

Successful fundraisers encourage engagement by asking – and welcoming – questions when talking to investors.

For example, questions you could ask investors include:

• Have you seen this before?

• Does that make sense?

• What are your thoughts on what we’ve shown you so far?

Fundraising Guide Tip #5. You’re an A team: convey it.

A cohesive, well-prepared team is like a sponge cake straight out of the oven. Ingredients together create something much greater than the sum of the parts.

If your team contradicts, interrupts or ignores one another, investors will doubt your credibility.

Instead, your interactions should be positive and seamless. Everyone who attends the meeting needs to contribute something relevant – otherwise, why are they there?

Plan beforehand who will answer which type of question and avoid any conflicts.

Fundraising Presentations Tip #6. The non-verbal is important too

Remember that nonverbal communication can be just as important as what is actually being said.

Subtle tips for transforming your body language during fundraising presentations:

• Pay attention to what you do when your colleagues are speaking. Look engaged and interested!

• Show that you are as interested in your investor as you want them to be in you.

• Practice – we do extensive rehearsing on camera with clients so that they are investor-ready.

Impressions are everything – investors’ perception of your team when you are with them is what matters. We’ve fixed many pitch disasters with extensive video coaching.

Fundraising Presentations Tip #7. Embrace challenging questions

Investors get frustrated by presenters who avoid, second-guess or provide scrambled answers to questions.

Remember, it is their job to ask questions and be critical.

We recommend that you prepare yourself for the Q&A session as much as you do for the fundraising presentation itself.

Before pitching to investors, look at your presentation objectively: what are the areas you are most likely to be challenged on?

Avoid being defensive or taking criticism personally.

Prepare your answers and rehearse delivering them confidently together as a team – the last thing you want is your team being surprised by each other’s answers.

Again, do extensive on-camera practice to prepare your team for Q&A.

Fundraising Pitch Tip #8. Manage your energy levels between investor meetings

Delivering a series of fundraising presentations back-to-back can – unsurprisingly – seriously affect your energy levels.

However, there are strategies you can employ to perform at your best even if it’s your sixth meeting in one day and you want to catch the last flight home:

• View each fundraising presentation as a standalone event – every meeting is equally important.

• Take a break between meetings – go for a walk outside to get some fresh air.

• Switch team roles – knowing each other’s roles inside out comes in handy here.

• Learn from each presentation – take time to review what went well, what didn’t, and what could be done differently next time.

Fundraising Presentations Tip #9. Practise, edit, practise, refine, practise

Fundraising presentations are the ultimate first impressions test.

And like all first impressions, it’s a one-time deal – there are no second chances. So it makes sense to prepare for what you’re walking into by doing your homework.

A 2014 study by Qvidian revealed that teams often lose deals because they haven’t customised their content to their audience’s needs.

Successful fundraisers thoroughly research each investor to better understand what’s important to them.

This enables you to focus your narrative around what the investor needs, and how you can solve their unique problems.

Once your narrative is in place, it’s time to put in the hours preparing, editing and refining your fundraising presentation.

No two presentations will ever be the same; the motivations and personalities of investors will always vary.

Fundraising Presentations Tip #10. Check whether you are investor-ready

The more investor-ready you are, the quicker and easier it will be to raise funds.

Credits:

THE PITCH DECK

The 10/20/30 Rule

• 10 slides or less — to explain your

business

• no more than 20 words per slide

• 30-point font size

Ten Slides

Ten is the optimal number of slides in a PowerPoint presentation because a normal human being cannot comprehend more than ten concepts in a meeting—and venture capitalists are very normal.

Twenty Words

No more than 20 words per slide will make presentations better because it requires

you to nd the most salient points and to know how

to explain them well.

Thirty-point font

The reason people use a small font

is two-fold: first, that they don’t know their material well enough; second, they think that more text is more convincing.

Jammed contents in the slide will let the readers assume you are just reading the slide and will read ahead of you, which causes them to be our of synch.

COMPONENTS OF A PITCH DECK

There are ten components of a pitch deck:

1. Problem

2. Solution

3. Product

4. Target Market

5. Traction

6. Reveo Model

7. Competition

8. Team

9. Ask

10. Summary

Mga Komento

Mag-post ng isang Komento